This year, one of the habits I'm trying to improve upon and track is my reading. I started outlining this episode and then I woke up in the middle of the night with some clarity and I've figured out what I needed to talk about. So it's almost 4:00 AM and here are my...

Ep. 81: 9 Ways to Help Your Kids Love Reading

This is something I am very passionate about, and I’m really excited to talk about. So I’m going to start off with a quote. And this is by Sarah Mackenzie. She is the author of “The Read Aloud Family.”

And here’s what she says.

“Home is the only place in which our children have a fighting chance of falling in love with books

I’m gonna read that again, “Home is the only place in which our children have a fighting chance of falling in love with books.”

Now I want you to think about, do you think this is true? Did that statement, kind of hit you in a different way than you expected?

I know when I read it, I initially I was like, huh, that is interesting. I wonder if that is true. And I started looking back at my own life and in my own education and thinking about did school make me love reading? No, probably not.

What made me love reading?

So I want you to do that for yourself. Look at back at your own education. Did school make you want to read, or did it feel more like homework or something you were obligated and you had to do?

Last week’s episode, that’s episode 80. I talked all about how to read more as an adult. We talked about looking back at your own timeline for reading what it looks like for you growing up and and what was the foundation for you to love reading or to not love it?

It’s really important to think about what kind of timeline are we setting our kids up for? I know for me, I talked a lot about how my parents made reading part of our daily life. And it was something that I loved. That foundation was why I love reading today.

I don’t think my love of reading came from going to school or taking classes in college about education or things like that. That wasn’t the thing that made me love reading. It was that foundation that my parents gave me.

As a parent, we have a huge opportunity to show our kids what reading is all about and to make it something that they will enjoy for us to their lives.

So this book, I just recently read “The Read Aloud Family” where I referred to that quote. Really has changed a lot of my perspectives on reading to my kids. I’ve read a lot of books about how to increase reading in your family and ways to make this happen and practical things to do. But this book really is amazing and it gave me some, some ideas that just hit in different place. I think sometimes you’re like, you know this, but hearing it, it’s just like, oh, it’s good.

One of the things that she talked about as a parent, we want to prepare our kids for their future and the life ahead of them.

But there’s no way to prepare them for all the challenges that they are going to undertake. Yet when we read books to our kids, they get to experience lifetimes of perspectives, of adventures that they don’t personally have to go through. They can live a thousand lifetimes before they leave our homes through the books we read to them.

Isn’t that amazing when you think of it that way. Like us reading to our children will help prepare them for whatever comes their way.

This is a quote from Sarah Mackenzie from the book. She says:

“When we read aloud, we give our kids practice living as heroes. Practice dealing with life and death situations, practice living with virtue, practice, failing at virtue.

As the characters in our favorite books struggle with through hardships, we struggle with them. We consider whether we would be as brave, as bold, as fully human as our favorite heroes. And then we grasp on a deeper, more meaningful level the story we are living ourselves, as well as the kind of character we will become as that story unfolds.”

Isn’t that powerful. I just love that. And I think that’s so true right now I’m reading to our kids, the little “House on the Prairie” series. This is the second time we’ve done this as a family. We did it two years ago and I think it’s going to be something we do every two years, because it’s so good.

Right now we’re close to being done with “The Long Winter.” And in that book, I don’t know if you’ve read the series, laura and their family they have hardly any food there’s blizzard after blizzard, they don’t have any, any wood in their home they’re having to use hay to create their own little like logs of wood made out of hay and they’re having to mill their own wheat with a little coffee grinder and their hands are cramping because they can’t keep on doing it. They have to do it at all times so that way they have some foods to eat for bread in the day. And they’re losing weight and all this stuff. And it’s like, oh my goodness. Their life is really challenging.

It gives you perspective on your own life how blessed we are to have food in our fridge and in our freezer and our pantry is full. We don’t even have to think about the heat and all these things that we just take for granted. It gives us perspective and our children perspective of what life looks like for other people. It helps us be grateful for what we have, and it helps us to have conversations with our kids of what would you do in this.

We’ve talked about, would you rather live in Almonzo’s home, which is Laura’s feature husband. Or live in Laura’s home. Why, why not? What things would you do in this situation? It gives us opportunities to talk with our kids about really important things. Preparing them for their future.

Today, what we’re going to do is we’re going to talk about nine ways to help your kids love reading.

The first one is to make reading a priority.

This is key. If you don’t make it a priority, your kids are not going to make it a priority because there’s a ton of other things that are more exciting probably for your kids.

Be an example. If your kids see you reading that shows them that reading is important to you. Read in front of your kids, read to your kids, be an example, show them that it is a priority to you, and it should be a priority for them.

You can make reading be something that you do as a family, create reading routines. Like maybe after lunch, everyone reads on their own.

That’s one of the things that she suggests in “The Read Aloud Family” book, which is amazing book I highly recommended. She also has a podcast, which is the “Read Aloud Revival.” If you like listening to episodes, that’s a great resource. How can you make reading happen on a daily basis?

The second thing to do is to read aloud as a family.

We do this a lot when our kids are really little, but the older our kids get, we kind of think, well, that’s something we don’t need to do anymore. Like they can read on their own. Why would I read as a family out loud? It is so powerful. Even when your kids are older and they can read on their own, it is so important to read out loud.

I look back at my own childhood, my parents read to us out loud for so long. I can’t even remember when that stopped. They read to us the “Lord of the Rings” books. We weren’t super tiny at that point. We had books read to us and it was something that connected us as a family. And there’s so much power in reading out loud as a family. It’s so good.

Here’s some ideas to do this. Read at the end of meals. This is something I’ve been doing with my kids, especially at lunchtime. I don’t know about you, but my kids take a long time to eat at the dinner table. I’m homeschooling my kids as well and I want to get reading in, in the pockets of time that we can.

So while they’re still finishing their meal and I’m done, I pull out books and I read to the kids until they’re finished eating. And a lot of times that’s maybe 10 minutes, but that’s better than nothing. It’s something.

We also do devotional readings at breakfast and at bedtime. That’s something that we just make part of our day.

I have an episode about the devotions that we love. If you are wanting to get some ideas on how to incorporate reading and adding devotionals into your day-to-day life, that’s a really good one to listen to it’s episode 47, and it’s called “Devotions for Kids that We Love.” And there are some amazing, amazing devotions I talk about in there, I would highly recommend checking those out.

A lot of times, if you’re going to just start devotion, you’re like, I don’t know which one I should do with my kids. What’s the best one? What would be good? Take a look at that and that’ll give you some really good ideas to go off of.

We also like to make sure that we read books to the whole family that we would all enjoy. Maybe not reading little picture books might not be the most exciting thing to do as a whole family.

These are the books you typically think of are, are longer. And maybe they don’t have as many pictures. These are more like the chapter books. I love reading classics to our kids. I feel like I don’t have to edit as much or be worried about are there going to be bad behaviors in it. Is there something bad in it?

So I really like reading classics because they are ones that are just tried and true. We love “Charlotte’s Web.” We’ve read that twice. We go through “The Little House” series, which I’ve already talked about, “The Secret Garden, “Ann of Green Gables,” “The Trumpet of the Swan.” There’s a bunch of different classic books that we’ve read. I don’t even know, probably close to like 15-20 of them.

And I really liked doing the abridged versions. There’s a lot of different abridged versions. There’s ones. I think they’re called the Lady Bug collection or “Lady Bird collection“, something like that. They’re really small and you can read “The Wind in the Willows” in less than a day.” Like really short.

If you want to get, even when your kids are really young, have them have some experience with these classics, they don’t have to be the full blown regular book, you can do some abridged ones and then work your way towards having the full regular classics.

So that can give you some, some ideas that there’s a lot of classics out there, and you can talk to the librarians and ask what they would recommend, but there’s a lot of really good ones out there.

The third tip I have for you is to let your kids do stuff as you read to them.

This is something that has really changed my perspective in the last several months. I never thought about letting my kids do anything besides just sit on my lap or sit next to me and we cuddle up and I read to them.

And I realized from the book, the read-aloud family, why don’t I let my kids do different things while I read to them? So, this has been really amazing for me because I have my kids draw or paint or they’ll use kinetic sand. They’ll do all kinds of different things while I read to them.

And this helps them pay attention a lot of times more and you could fit reading in because they’re able to do more than one thing at a time. They could do this while they’re sewing or crocheting, or knitting, all kinds of different things, things that they don’t have to really think about.

Just yesterday, I read to my kids while they clean their room and their playroom. I just read and that way I was still able to monitor to make sure that they’re getting their stuff done, but it made it a lot more enjoyable that they got their stuff done, and I got to read to them while they’re cleaning up. There’s a lot of ways that you can make this happen.

When we had our hot tub, I would bring books and I would read to my kids in the hot tub. That was something that we did on a regular basis. And I just made sure that there was no splashing and kept the books dry. You can make this happen in so many different ways.

Tip number four is to go to the library.

One of my pet peeves is going to the library and I hear this almost every single time I go. “You could only get two books.” Some parent is telling their kids. Only get a certain amount. You can only choose three books. That’s it. And I feel like it’s so important to not limit our kids with reading.

The library is a free resource. Why limit your kids with how many books that they can get? I let my kids check out as many books as they want. I give them each their own bag. We have a roller duffel bag that I normally use. And then each of the kids have their own reusable bag and they fill them.

And we go to the library typically every week, sometimes every other week. And we fill them up and whatever their bag holds that is their limit.

So that is a great way to just make reading happen. And I love that when we go to the library, my kids get to choose whatever books they want and if they don’t like it, it’s okay. We’re going to return the many ways.

My kids, they each have their own library card. They get a check out their own books. They get to keep the receipt.

They are all in. They return the books, you know, we’ve got the returner. They’re like beep, beep, beep, beep, beep, and it goes through and picks it up and like, they love it. They do all of it and they are fully invested in it. And I think the more we let our kids just be part of the process, it makes it really exciting for them.

And letting them just be able to choose whatever they want has been great. And so that’s one of the things that I really recommend, like you use this free resource. It’s amazing libraries are so much better than when I was a kid. They have so many resources out there available. Go to them and let your kids check out books.

We have a designated area in our house where we put all of our library books and then in the kids rooms. They have their little section where they put their library books. We don’t have any issues with them being lost or anything like that.

Figure out some kind of system and let your kids check out a ton of books. The more books they have, the more they’re going to want to read.

All right here is the next tip.

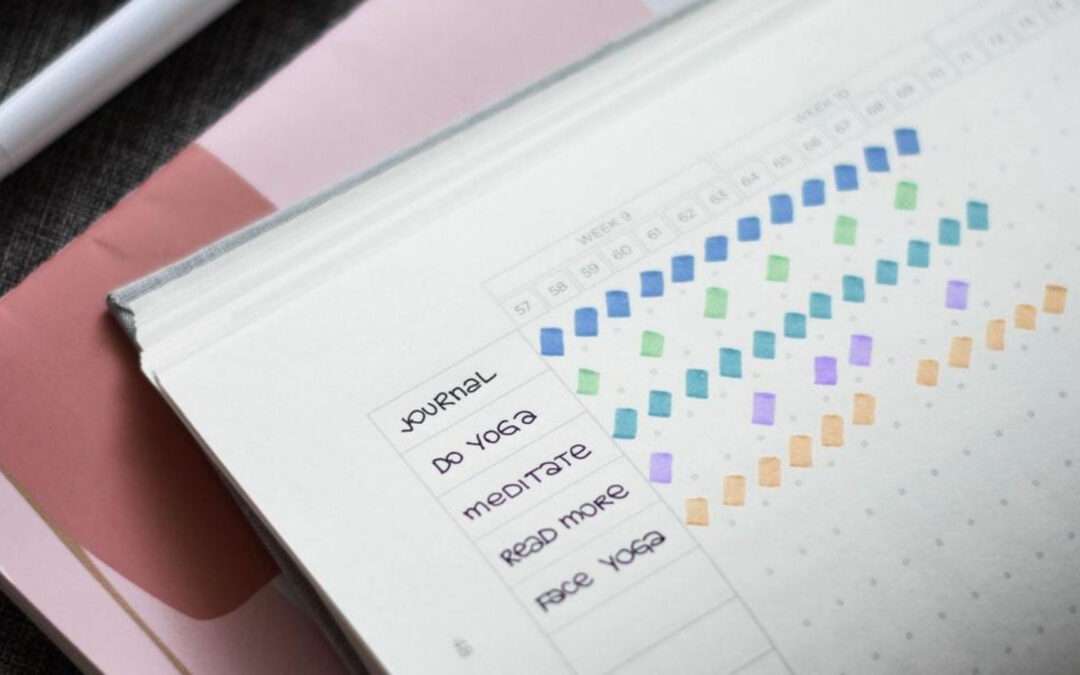

So this is tip number five. Join reading programs that have rewards.

It’s been really helpful for our kids to have a reading program where they’re being kept accountable. They have to record how long they’re reading to be able to go to a water park or a theme park.

Even libraries have systems where they give rewards for reading a certain amount.

Our library had a reading reward and Jonathan won his age group of reading. He got a $20 gift card to Lake Shore Learning and he picked out a helicopter and he was so excited that his reading got him the ability to get this helicopter. It was a drawing, so it was random, but it was amazing. He actually won it. But they also got a free book and they got coupons and a bunch of other things.

Right now, our kids are working on two different passes, one for a water park and a theme park near our home.

My daughter read for an hour yesterday on her own. And then the day before she read for two and a half hours on her own. She’s seven and I’m like, this is amazing. She’s having this amazing time, like where she is like, I’m so excited. I get to read and she goes into her room and she puts a timer on and she reads. And even if I go in there, she’s like, I’m on a timer I need to read and she’s just on a roll reading, all of these books that she wants to for her time.

And she has to read I think, 10 hours. So she’s going to get it really quick. But those kinds of reward programs can really help your kids have an extra incentive to read.

Even if you’re homeschooling, like we’re homeschooling, they still have those rewards for kids that are not in regular public school. If you are homeschooling ask around homeschooling co-ops, if there’s Facebook groups ask if there’s anything going on.

Typically they have those kinds of rewards for waterparks and theme parks and things like that. Look into those.

My sixth tip is to talk positively about reading.

Don’t let negative talk, come out of your mouth. When you talk about reading. This is so key. You have to be the example.

If you talk poorly about reading your kids will too. They catch on. If you think reading is challenging, if you think reading is not fun, your kids are going to have the same thought as you.

You need to make sure that what you’re saying is good and positive. Especially going to the library and hearing parents say, “Oh, you only can get two books.” You’re telling your kids limit how much you can read. And maybe I’m stepping on toes here, but that’s just something I really am passionate about. You want to let your kids have the opportunity to read as much as they can.

Be an example, talk good things about books that you’re reading. Make it something that is enjoyable, what you say matters and how you say it matters.

When your kids finish a book, when they’re starting to read, be excited, show them that this is a huge deal. Like you’re reading a book. This is so exciting. You know, this is.

This is awesome. We need to be an example.

My seventh tip is don’t be so busy.

Reading helps you slow down. Our kids want us to be present. They want us to be there. And if we are consistently on the go, you’re going to have a hard time making time for reading. You need to make sure you are prioritizing it, and maybe you need to make some cuts.

You can add reading into all these little pockets of your day. You can make it something that’s really part of your life. But we also need to make sure that we leave some white space for our kids to be able to be imaginative, have time to read and be on their own for that. It’s really, really helpful.

Here is my tip number eight: Give your kids opportunities to read to each other when they get older.

This has been powerful. When I am recording, like I’m recording right now, I have a list that I give my kids to do while I am in here. My husband’s in the house so it’s not like they’re totally unintended or anything.

But I have a list of what they need to do and every time I’m recording, one of the things I have them do is I have my daughter be to my son.

I write down that she needs to read three books to him. It’s really good for both of them. My daughter gets to practice reading out loud to someone else.

There’s a lot less pressure when you’re reading to a kid younger than you than reading to a parent. Even if you feel like there shouldn’t be pressure for her reading to me, but there is. It’s different when you’re reading to someone who’s younger than you.

Then for my son to see, “Wow, my sister is able to read this book.” He’s learning new things and it’s just so good for both of them. Have your kids connect and use this as an opportunity.

Our neighbor would have our kids come over and have their youngest kids practice reading on our children. You can do this with neighborhood kids if your kids are really young. It’s a great way to have both kids get a lot out of it.

My last tip for you today. Is to make reading time cozy and inviting.

I don’t know if you’ve heard of Hygge, but it’s H Y G G E. It was pretty popular a couple of years ago. I don’t see it as much anymore, but it’s a whole way of being, and, and it’s, it’s really, it’s.

It talks all about how to make your life cozy. And. And inviting and it’s, it’s a Danish word and it’s what people in. What the.

So Hygge is a Danish word and it really means to be cozy and just work on the environment to make it something very inviting. Like they light candles, they have mood lighting, like the lights actually matter. All of these little things that you don’t even think about having really comfy blankets, just make this something really cozy, especially in winter time.

Think about how you can make reading Hygge. How can you make it something that is just so inviting that you just like, Ugh, it feels so good. How can you cuddle up with your kids and snuggle up with a blanket and read to them?

I have a designated spot in our house. We’ve got this Pillow Sack. It’s a Love Sack thing that I sit there and my kids are on both sides of me and I have this really furry blanket and I sit there and I read to my kids and it is just amazing.

A lot of times when we’re at the table and I read to my kids, I have a candle lit and we even do that for doing schoolwork. We have a candle on a lot, and it’s just this way to make it more cozy and inviting and make the environment more exciting for reading. A place where we just really feel like, oh, this is a way to connect.

My kids love reading so much. We do date night with our kids every Wednesday night. And my husband, I just switch off with each of our kids and almost every single week, whoever I have as the kid that I have a date with, they asked for me to read to them.

That is one of the things that they long for, even though I do it every day, like they want to do one-on-one time on their date with me reading to them, which I think is amazing because that’s something that they feel so connected to us when we read.

When I look at my own life, when I feel the most connected with my kids, it’s when I read to them. Hands down. That is when I feel so connected with them because I’m not doing anything else. I’m not distracted. I have them on my lap. And it is just them and me and we’re reading and we’re doing a story together and I talked to them through it and it’s just magical.

My hope is that you have that experience, that the time where you feel most connected with your kids is when you read to them. It is something that connects more than anything else. It is so powerful.

And I really hope that that gives you some ideas and makes you want to read to your kids more because it is amazing and I want you to taste that for yourself.

I have a podcast episode all about how to create a family culture that loves to read that’s episode 23. If you want to get some more ideas, that’s a great resource to look into.

And if you are trying to figure out, well, I don’t know what books to read to my kids. And if your kids are younger, I have created a list of books that we love. I was trying to think about how many kids’ books. I’ve read. And I don’t even know. I’m guessing it’s probably thousands upon thousands. I have no idea really. I can’t even try to figure that out.

Like we’re at the point that the transportation section in the library. I’m like, we’ve checked out a lot of these books, like three to four times we have read the whole section from front to back. It’s kind of crazy. My son is just all about the transportation stuff.

But there are a ton of books out there. And if you want to get some ideas of what books we love. You can go to richlivingonless.com/books. And I have created a list of books. It’s a free download. And that can be a starting point for you because we’ve read a ton and these are our favorite favorites.

And that can give you some ideas of what to start with. Let’s start reading.

I wanted to end today’s episode with two quotes. From Sarah Mackenzie from the “Read Aloud Family.”

” We read with our children, because it gives both them and us and education of the heart and mind of intellect and empathy. We read together and learn because stories teach us how to love.”

It’s so true. I just feel like that is just so powerful.

And another quote from her just to end this and give you some ideas and encourage you to read to your kids more. Here it goes:

“A book, can’t change the world on its own, but a book can change readers and readers, they can change the world.”

So, go, read to your kids, and enjoy this week.

More From This Category

Ep. 80: 7 Ways to Create Time to Read

Ep. 81: 9 Ways to Help Your Kids Love Reading

Hey friends, welcome to today's show. I am really excited about today's topic. We're going to talk about how to make reading happen more with your kids. This is something I am very passionate about, and I'm really excited to talk about. So I'm going to start off with...

Ep. 78: Habit Stacking

Hey friend, welcome to today's show. This whole year, we have been going through a lot of information, helping us create change in our lives without using a typical New Year's resolution. In my podcast, episode 75, we talked about why resolutions typically fail. And a...

Comments